When we first started our company, many business owners asked us why they should use our W-9 form management software instead of just using email. This is a valid question.

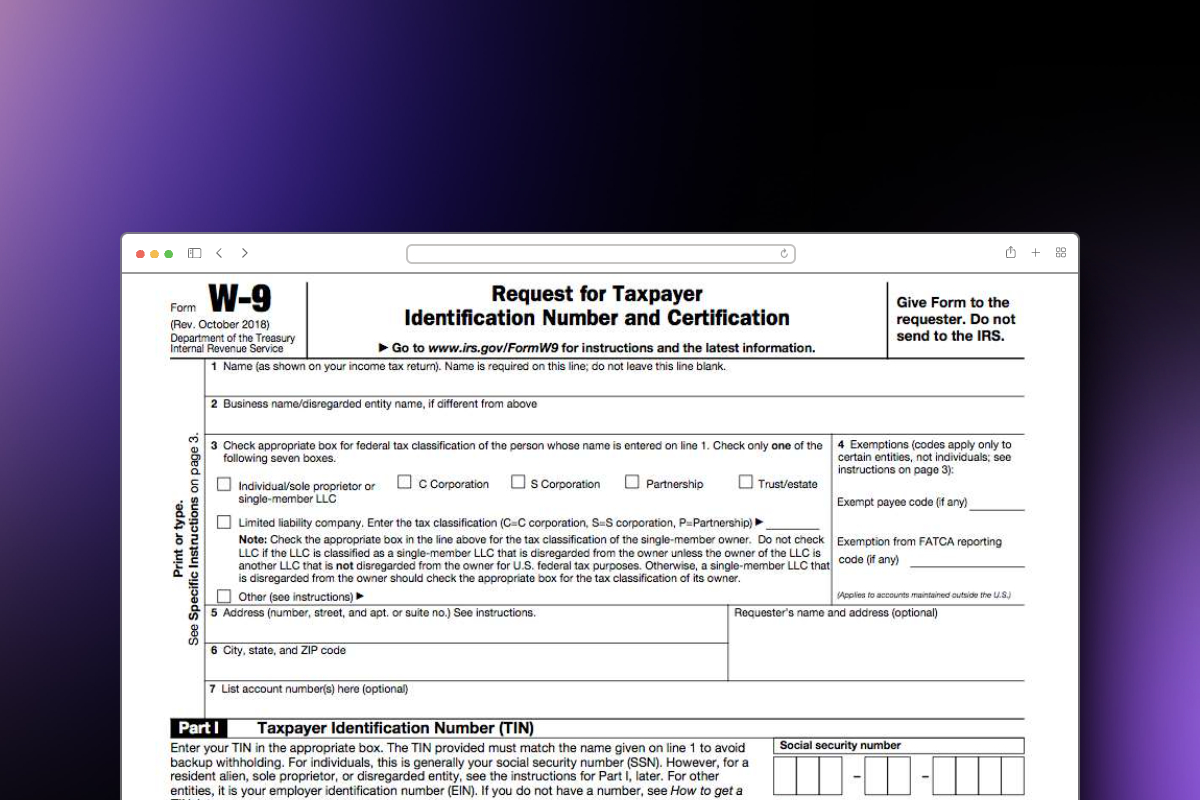

Considering that a W-9 contains sensitive information like a taxpayer identification number (TIN) or Social Security Number (SSN), we strongly recommend every business owner use a secure method for handling these forms (and not email).

In this article, we'll discuss why you should never send a W-9 form over email and alternatives to request these forms from vendors and contractors securely.

Why You Should Never Send a W-9 Form over Email?

Email is a common tool in business communication, but when it comes to transmitting sensitive documents like the W-9 forms from IRS, there are several risks:

- Lack of Encryption: Most standard email services do not provide end-to-end encryption. This means that unauthorized parties could potentially intercept and read your email during transmission.

- Vulnerability to Phishing and Scams: Email accounts are frequent targets for phishing attacks. If a business's or vendor's email is compromised, sending a W-9 form could inadvertently expose sensitive information to cybercriminals.

- Human Error: Simple mistakes, like sending an email to the wrong recipient, can lead to unintended data breaches. With W-9 forms, this risk involves exposing someone's personal tax information.

- Data Storage and Access: Emails with sensitive attachments can remain in inboxes or servers indefinitely, creating long-term security risks. Unauthorized access to these emails can lead to data leaks.

Given these vulnerabilities, relying on email to send and receive W-9 forms can be risky.

In the next section, we'll share how you can use Secure W9 to manage and automate these important documents.

How to Securely Request and Send W-9 Forms with SecureW9?

Our W-9 form request and management platform simplifies the process from start to finish, ensuring security and efficiency at every step. Here's how it works:

Step 1: Signing Up and Adding Vendor/Contractor Information

Quickly sign up for a SecureW9 account and add your contractors' and vendors' details, such as names and email addresses.

Step 2: Sending W-9 Request Emails

The platform automatically sends out W-9 request emails to your vendors and contractors, complete with instructions for secure submission.

Step 3: Receiving and Securing W-9 Data

As vendors submit their W-9 forms, Secure W-9 encrypts this data for security and then securely transmits it to your business.

Step 4: Accessing W-9 Forms When Needed

You can access the encrypted W-9 information anytime through your Secure W9 account, ensuring it's always available for tax or compliance needs.

Step 5: Automating the Process

Secure W9 allows you to set up automatic reminders, saving your hours in manual follow-up and making the W-9 collection process more efficient.

With SecureW9, managing W-9 forms becomes a secure, straightforward task, freeing you from the complexities and risks of manual processes.